Understanding the 2025 Social Security COLA Increase

The Cost of Living Adjustment (COLA) is an annual increase in Social Security benefits that helps beneficiaries keep pace with inflation. This adjustment ensures that the purchasing power of benefits remains relatively stable over time.

Factors Influencing COLA Calculation, 2025 social security cola increase

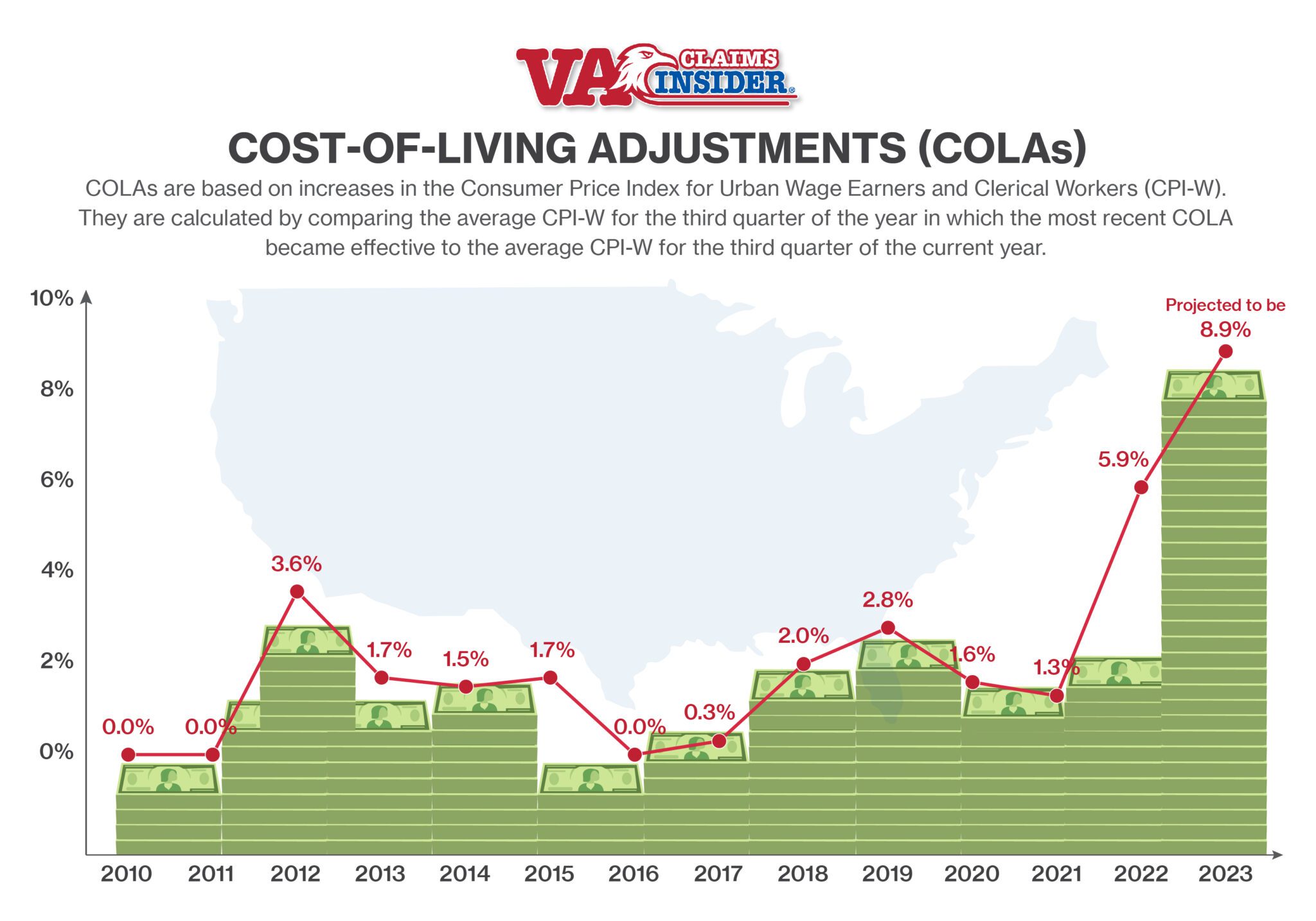

The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the average change in prices paid by urban wage earners and clerical workers for a basket of consumer goods and services. The COLA is determined by the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year.

Historical Overview of Social Security COLA Increases

The COLA for Social Security benefits has varied significantly over the past few years, reflecting fluctuations in inflation.

- In 2023, the COLA was 8.7%, the largest increase since 1981, driven by high inflation rates in 2022.

- In 2022, the COLA was 5.9%, a significant increase from the previous year’s 1.4% increase.

- In 2021, the COLA was 1.4%, a relatively low increase due to moderate inflation rates in 2020.

- In 2020, the COLA was 1.6%, a modest increase compared to the previous year’s 2.8% increase.

Projected 2025 COLA Increase: 2025 Social Security Cola Increase

The projected Social Security Cost-of-Living Adjustment (COLA) for 2025 is a crucial factor for millions of Americans who rely on these benefits. The COLA is designed to protect the purchasing power of Social Security benefits against inflation.

The projected COLA increase for 2025 is based on current economic indicators, specifically the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W measures changes in the price of goods and services typically purchased by urban wage earners and clerical workers.

Projected COLA Increase for 2025

The projected COLA increase for 2025 is currently estimated to be around 3.0%. This estimate is based on the average CPI-W inflation rate for the third quarter of 2024, which is the period used to calculate the COLA. However, it’s important to note that this is just a projection, and the actual COLA could be higher or lower depending on how inflation evolves in the coming months.

Impact of the Projected COLA Increase

The projected 3.0% COLA increase would provide a modest boost to Social Security benefits for 2025. However, it’s important to consider the impact of inflation on the purchasing power of these benefits. If inflation remains high, the COLA increase might not fully offset the rising cost of living.

Implications for the Long-Term Sustainability of Social Security

The projected COLA increase for 2025 highlights the ongoing challenges facing the Social Security program. The program’s long-term sustainability depends on a delicate balance between incoming revenue and outgoing benefits.

Impact of the COLA Increase on Beneficiaries

The 2025 Social Security COLA increase will directly impact the monthly benefits received by millions of Americans. The extent of this impact will vary depending on individual circumstances, such as the amount of benefits received and other sources of income.

Estimated Increase in Monthly Benefits

The COLA increase will result in higher monthly Social Security payments for beneficiaries. Here’s a table showcasing the estimated increase in monthly benefits for different income levels:

| Monthly Benefit (Before COLA) | Estimated COLA Increase | New Monthly Benefit (After COLA) |

|—|—|—|

| $1,000 | $100 | $1,100 |

| $1,500 | $150 | $1,650 |

| $2,000 | $200 | $2,200 |

| $2,500 | $250 | $2,750 |

This table provides a general overview of the potential impact of the COLA increase. The actual increase for each beneficiary will be determined based on their individual benefit amount.

Impact on Purchasing Power

The COLA increase is designed to help beneficiaries maintain their purchasing power by offsetting the effects of inflation. However, the effectiveness of the COLA increase in preserving purchasing power can vary depending on the specific rate of inflation and the cost of living in different regions.

Impact on Financial Planning and Retirement Security

The COLA increase can have a significant impact on beneficiaries’ financial planning and retirement security. For many beneficiaries, the increase may provide some relief from rising costs and help them maintain their standard of living. However, it’s important to note that the COLA increase is not a guarantee of financial security. Beneficiaries should continue to plan for their retirement and consider other sources of income to ensure they have sufficient financial resources to meet their needs.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is a topic of much discussion, with some predicting a significant increase due to rising inflation. However, the debate over the COLA’s impact is often overshadowed by other pressing issues, such as the recent nassau county ban masks controversy.

While the mask mandate debate has garnered significant attention, the COLA’s potential impact on the financial well-being of millions of Americans should not be overlooked.

While the 2025 Social Security cost-of-living adjustment (COLA) is eagerly anticipated by millions of retirees, the impact of natural disasters like tropical storm Debby hurricane can significantly affect the lives of those relying on these benefits. The storm’s devastating effects on infrastructure and livelihoods can exacerbate financial hardship, making the COLA increase even more crucial for economic stability.